The creation of a company is a real course (of the fighter). One of the first difficulties is to choose the right legal status to create your business.

Depending on the nature of the activity you want to launch, certain legal statutes have advantages and disadvantages. Your personal situation can also have an impact. If you want for example free from freelancemicro-enterprise can be a good springboard.

Let us see together which aspects to take into account in the choice of status for your business creation.

Some tools in this article are sponsored. They include the mention “sponsored”. Discover how Sponsor your tool.

Swapn : certified expert advice to choose your status

Launching its freelance activity has never been so accessible with Swapn ! We support you free of charge in the creation of your business by advising you on the most suitable legal structure and taking charge of all registration procedures.

Thanks to our 100 % online service, you can be operational quickly, without worrying about administrative formalities. SWAPN is registered with the order of accountants, ensuring reliable support and in accordance with the regulations.

Micro-enterprise, SASU, EURL … Are you hesitating about the status to adopt? Our advisers will guide you to the best option!

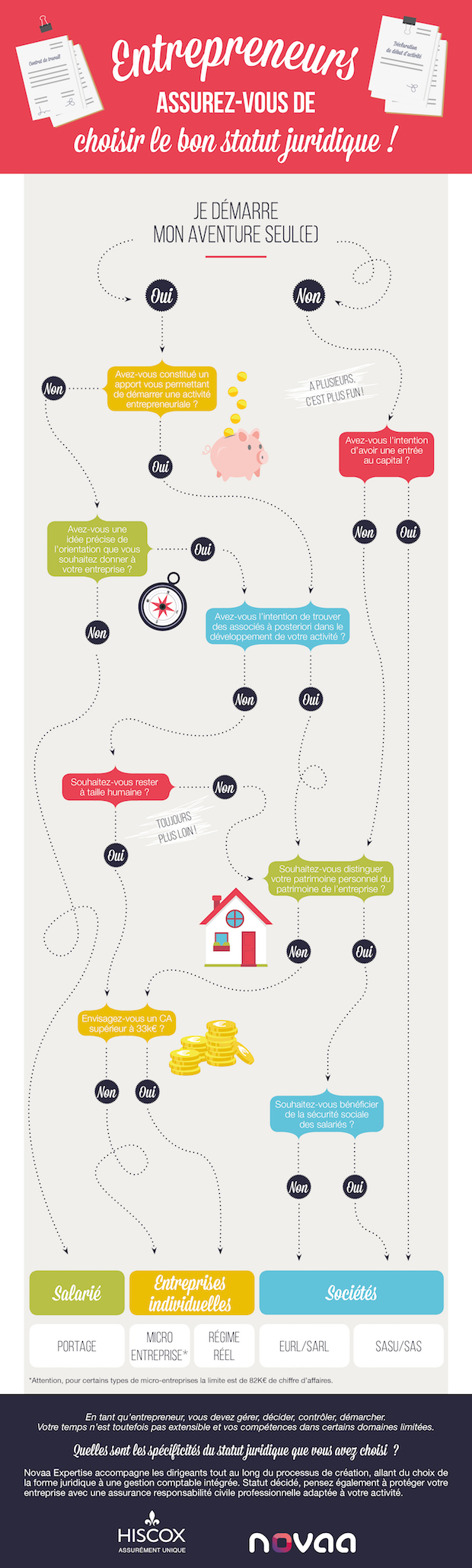

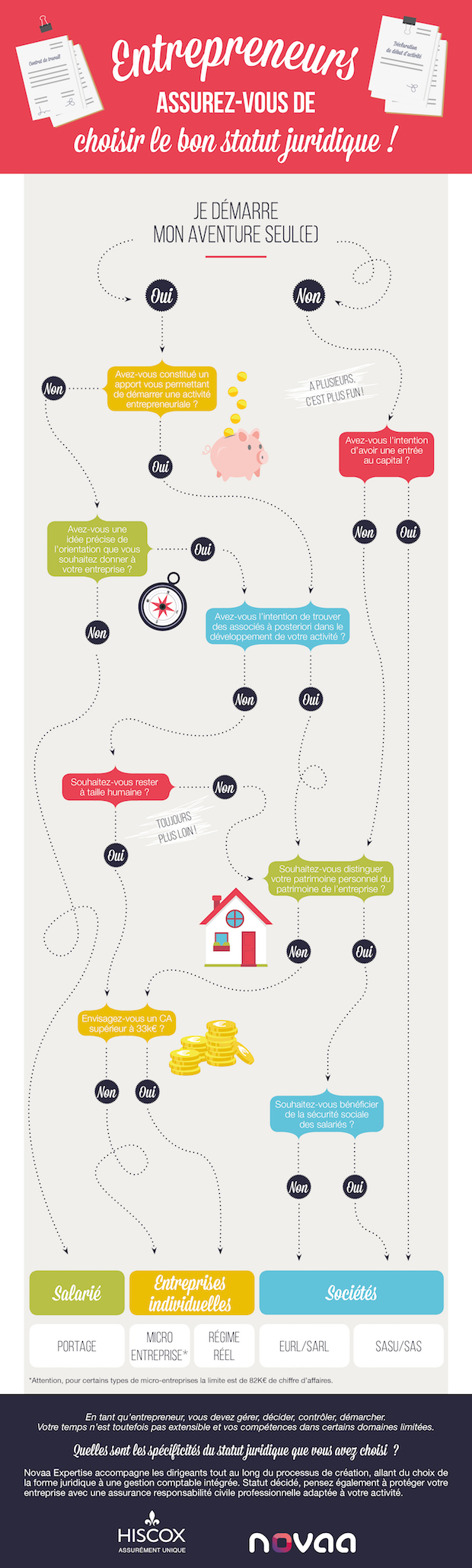

Infographic to choose your legal status to create your business

Hiscox, insurance company and Novaa Expertise, accounting firm, bring you some answers in this infographic:

Choose a legal status to create a freelance company

Being freelance is working alone, but not necessarily stay alone. Your strength, as an entrepreneur, is to be accompanied by partners and professionals. The CCI, the accountant, or even business clubs are partners who are likely to help you in your strategic decisions.

To start, know that a starting capital greatly facilitates entrepreneurship, including freelance. Despite this, financial capital is not always necessary, according to the profession that you will exercise.

Besides, do you have an idea on the orientation that your business will take? Will she stay on a human scale? Are you going to take associates to see her grow? What level of that have you decided to reach?

- If you do not have a precise idea of the job, opt for the wage. The opening of a business is not yet mature enough to succeed. This is only a postponement.

- An intermediate solution (employment-entrepreneurship) is the wage portage. You keep an independence of operation (like a freelance), but you do not manage the administrative aspect which is assumed by the company which employs you for the missions.

- If you have found your Business creation ideabut that you want to work solo, while retaining a human scale and an annual turnover close to € 33 k, opt for the status ofsolemn. The tax regime is left to your approval: microentprise or real regime.

Choose a legal status to create a business with several

If you are alone, do you have a sufficient financial contribution to start your activity? If yes, do you want to find partners to develop your business? If the answer is still yes, remember to differentiate your personal assets from your professional heritage. Your most logical choice is: Company status.

The tax regime can be decided between: EURL, SARL, SASU, SAS. Each status has advantages, but also disadvantages. Your choice will therefore depend on your needs and your objectives in terms of business development.

Legal statutes are not to be chosen at random. Their impact is important on your operation and your legal obligations. The EI Microentreprise status does not legally require the intervention of a chartered accountant, for example.

Even if his expertise is highly recommended to help you enter your role as business managerbut also to guide you to the best evolution solution for your business.

Do you want to know more? You will find a lot of information in our file: Become freelance: the guide to choose your status.