A mutual TNS (or complementary health) is an insurance that reimburses all or part of your medical costs and is specialized for the self -employed.

Unlike employees who benefit from the business mutual insurance company, TNS (non -salaried workers) must subscribe to their own initiative.

Even if this is not compulsory, this approach is very interesting, because social security only partially covers your health expenses. A TNS mutual insurance company thus makes it possible to complete the reimbursed amounts.

To help you navigate among the offers offered, discover our ranking of the 10 best TNS mutuals.

The best TNS mutuals in 2025

1. Stelloyour tailor-made health protection

Stello (formerly easyblue) is a TNS health mutual that allows you to benefit from the same protection as an employee, that is to say to benefit from the refund of your care for you and your family.

The covers are adjustable and scalable, according to your needs and your family. For example, you can take advantage of reimbursements adapted to your situation:

- up to € 62 of reimbursed general consultation

- € 127 consultation with a cardiologist

- 156 € of psychiatrist consultation

- up to € 1,500 for orthodontics

- A € 200 package for lenses

- up to 350 €/year for glasses

- 180 €/year in alternative medicine: osteopathy, sophrology, acupuncture, etc.

- € 100 per night's stay in a single room + transport

Stello offers you:

- 1 month of mutual insurance offered with the code “Freeland_1mois“” “

- the third-party payment;

- an adaptable coverage;

- A team to help you by cat, email phone if necessary.

Did you know? Your TNS mutual insurance company is deductible from the taxable income of your company thanks to the Madelin law !

2. Apicil: the best Mutual TNS

Apicil is an insurer group that offers a TNS mutual insurance company suitable for self -employed workers.

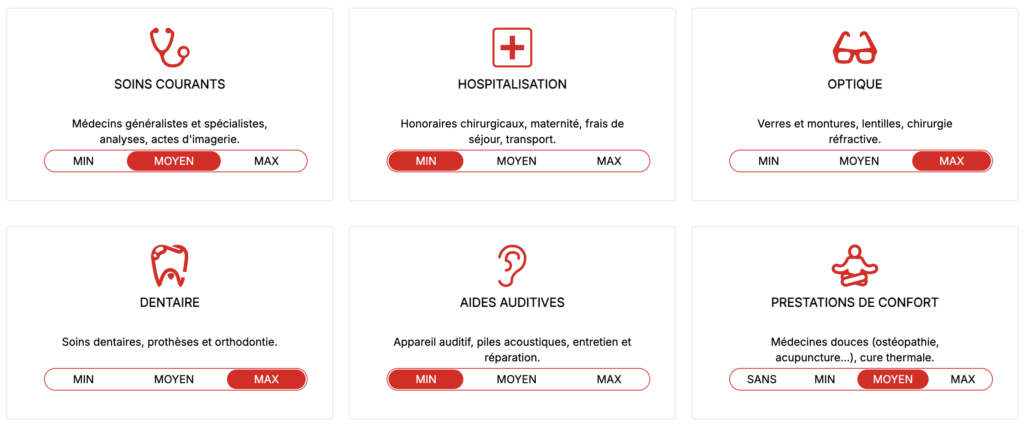

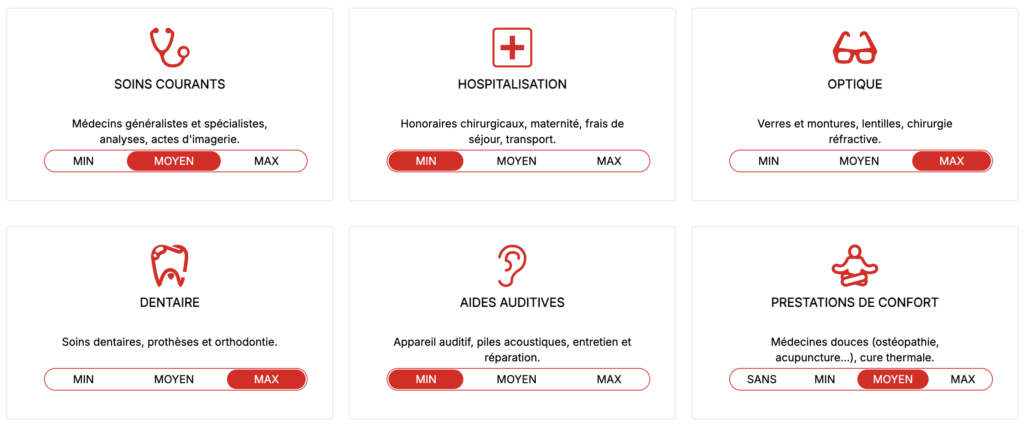

You can choose your level of guarantees through six categories: current care, hospitalization, optics, dental, hearing aids and comfort services. Apicil is a large mutual that also offers:

- the third-party payment, to avoid putting forward the costs;

- a 24 -hour teleconsultation service, including for psychological support or simple questions;

- A 2nd medical advice.

3. WEMIND: Mutual TNS Online

Wemind is online insurance dedicated to self -employed workers, which offers a mutual with a complete.

Wemind is at the top of our ranking of the best TNS mutuals, because they give access to:

- discounts on a selection of services (tools, software, cinema squares or subscription to the gym, etc.);

- An active mutual aid community.

4. GSMC: The TNS mutual insurance company designed for the self -employed

GSMC is a mutual that offers a offer dedicated to self -employed.

With the GSMC mutual, TNS can take advantage of a complete coverage:

- hospitalization,

- current care,

- dental,

- optical,

- alternative medicine (for example, session with an osteopath or an acupuncturist)

With prices adapted to all needs and all budgets, The GSMC mutual stands out for its wellness orientation:

- many premium subscription services to a Selection of health and well-being applications offeredto help you take care of yourself;

- no deficiency deadline;

- of the Refunds in less than 48 hours ;

- third party ;

- A mobile member space to easily pilot your reimbursements;

- The termination for you of your old mutual;

- The possibility of completing your coverage with a death provident if you wish.

5. ACHEEL: Health insurance for TNS

Baked is simple insurance is accessible. You can adjust your guarantees according to your needs. In addition, Achael engages with:

- the third-party payment;

- Refunds within 72 hours.

6. April: The Mutual TNS Pro

April is a complementary health that offers different levels of covers for the self -employed and provides you with the following services:

- The third-party payment available via a mobile card;

- reimbursements within 24 hours;

- A teleconsultation service.

April is one of health insurance leaders. You therefore benefit from all the classic advantages such as a mobile application to request your refund, quick appointments from certain specialists and high guarantees levels.

7. Airy: a dedicated TNS mutual offer

Airy is an insurer with agencies in all of France. They developed an offer differentiated by status, from the micro-entrepreneur to the company creator. We have selected aeri for its advantages:

- A flexible contract, making it possible to change the guarantees on demand;

- The third-party payment, to avoid putting forward the costs.

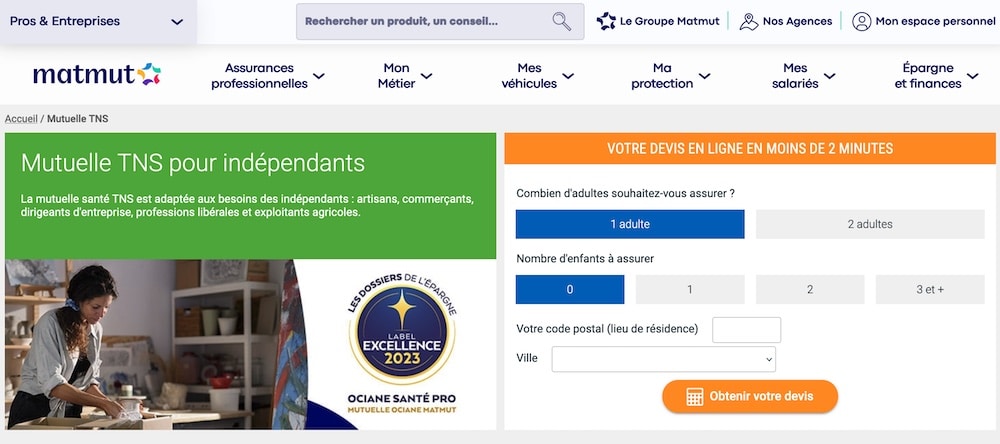

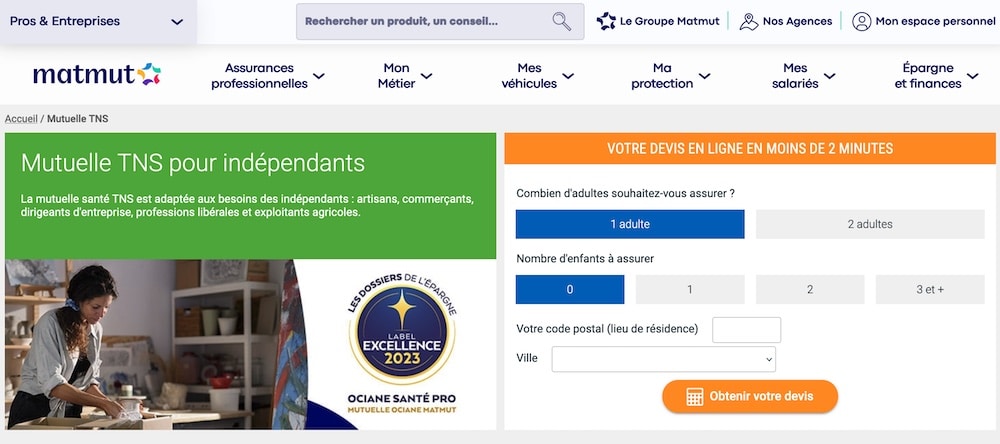

8. La Matmut: a TNS mutual for the self -employed

There Matmut is a traditional insurer that offers a mutual offer for TNS, with 6 levels of guarantees. They will allow you to have access to:

- a paid third party card accessible from your mobile, or if not, reimbursements in 48 hours;

- a teleconsultation and health coaching service;

- A 2nd medical advice.

9. APIVIA: The Macif TNS mutual

Apivia is a modular mutual health offer, with 5 levels of guarantees and 4 optional reinforcements. You can also take advantage of the following services:

- the third-party payment;

- a teleconsultation service;

- Assistance 24 hours a day.

10. The Mutual General: A good Mutual TNS

La Mutuelle Générale Offers 3 formulas to meet your health needs and you can benefit from the following features:

- the third-party payment, to avoid putting forward the costs;

- A 24 -hour teleconsultation service.

How to choose your Mutual TNS?

To select the best mutual insurance company adapted to your needs from all these offers, we recommend that you follow these 4 tips:

Identify your health needs

Take stock of your situation:

- Do you often need to buy medication or use alternative medicine?

- What about your glasses or your dental costs?

- Do you have to cover your spouse, children?

- Do you have a baby project?

All these questions will help you browse simulators and comparators of the different TNS mutuals to verify that they cover your needs.

Opt for a healthy health offer dedicated to TNS

We advise you to turn to a mutual insurance company that has developed an offer dedicated to TNS. Indeed, pricing will be more interesting, because adapted to the particularities of TNS status.

In addition, an insurer dedicated to the TNS will have provided that the subscription is deductible from your taxable costs thanks to the Madelin law (if your status allows it).

Favor a really practical mutual

Because you work on your own, it is very likely that you only have a limited time to devote to the administrative. We therefore advise you to choose a complementary simple and flexible health.

Some offer 100% online membership, the termination of your old mutual and a digital customer area.

Also check that the third party payment is possible, to avoid putting forward the costs, or that the reimbursements are made quickly.

Study the advantages offered by complementary health

Some mutuals today offer many services to allow you to take care of your health:

- sport,

- Help with parenting,

- sleep,

- psychological support,

- etc.

Do not forget to check the list of advantages and that your mutual insurance company corresponds to your lifestyle.

In summary: What is the best Mutual TNS?

A good health mutual is an insurance that allows you to modulate your offer and offers practical features like third-party payment or even a mobile application.

Mutuelle Stello's offer has the advantage of combining these criteria, and above all, it allows you to take advantage of many services to take care of your health and make your family benefit.

Take advantage of a month offered with the “Freeland_1mois” code To start covering your health costs now.